PITHAMPUR PLANT

World class manufacturing with a capacity of 90,000 vehicles per year

Explore More

BHOPAL PLANT

Industry 4.0 compliant manufacturing with a capacity of 1 lakh vehicles per year

Explore More

BAGGAD PLANT

The multi-model bus body plant manufacturing light to heavy duty buses

Explore More

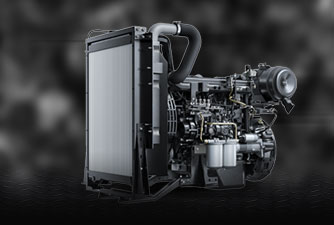

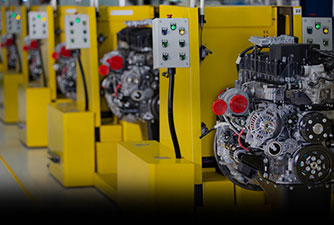

VE POWERTRAIN PLANT

A global hub for meeting the medium-duty engine requirements of Volvo Group

Explore More

HOSAKOTE PLANT

India’s first complete bus manufacturing facility

Explore More

DEWAS PLANT

One of the largest gear manufacturing facility backed by advanced technology

Explore More

SEZ PITHAMPUR PLANT

Specialized manufacturing facility for auxiliary gearboxes

Explore More